Stamp Duty And Registration Charges In Bihar 2025

If you have recently got the land registered in Bihar or you are going to get the land registered or you are associated with this work, then this blog can be very important for you somewhere.

If you come to know what is the MB capital market value of the land you are going to get registered and how much is the cost of registration going to be, then in such a situation there is no chance of you getting caught. No one can fool you and take even ₹1 from you.

So in today’s blog, we are going to tell you in full detail that how can you get the MB of your land online from home, the cost of registration, star value, the stamp duty that you will have to pay, how much it will be, then no matter who has taken the stamp, no one can take ₹1 from you.

We give you a hundred percent guarantee that there will be no scope for you to lose even ₹1 in the registration of the land and you can also use our stamp duty calculator for stamp duty information.

The first option is to go to the property registration details, here you will first see your and Bihar Rally, you have to click on it and after going to the value, you have to select your registry office where you are going to get the land registered.

What happens there is that in many districts there is a registrar and a sub-registrar, all these registrations happen, so in any district there are two registries, so in this you have to decide where you will get the land registered

And this is not a bank that if your land comes under a certain registrar then you have to get it done, you can get it done by going to any registry office of the district, in the district where there is only one, then there is no problem for that

For those where there are two, we are telling that you have to go to the location of your property, so first of all you use your registry office and after that you search your zone i.e. block in it that whether your area is coming in the space or not, if it is not coming then you can select other offices of your district

For accurate information, we have not told you which registry office you should go to or if you want to get an affidavit or agreement made, then you can get it made for free by going to estamppaper.com

So after selecting the registry office, you have to go to the zone You have to select it. After selecting the zone, you have to select your police station code. If you do not know how to find the police station code, then you can check it on the official website from our home page

Suppose you have bought a property in the state of Bihar. So the next step would be to get it registered. When you register the sale deed in the sub-registrar office. So you have to pay stamp duty.

Now the question arises that how will the stamp duty be calculated? And at what rate will it be calculated? The rate at which you have to pay stamp duty is called the value of the property.

There are two rates in this the first rate is the rate at which you have bought that property. And the second rate is the minimum registered value which we also call the minimum value of land in Bihar so on which of these two values you will pay stamp duty it can be any residential property as well.

Suppose its value is ₹50,00,000 but the rates published by the government are approaching its minimum value of ₹40,00,000. Because the minimum value is less than the market value so you have to pay stamp duty at the market rate in this situation.

And on the other hand we take another example suppose the market value is ₹50,00,000. And the minimum value is ₹60,00,000 so in this case the market value got reduced. And the minimum value is more then in this case you will do the registry at the minimum value and the stamp duty will be calculated on the rate ok now the question arises where will this minimum value be published?

How to find out so it is easily available online you will find it on the website of Bihar government if the market rate is less then the registry will be at the minimum value if the market rate is more than the minimum value then the registry will be at the market rate there is a simple logic why does this happen?

The government has done this because they do not want to lose revenue. Because there is a lot of cash transaction in property. Cash transactions cannot be tracked, so the market rate is often not known for this reason the minimum value is published in every state

It is also known by different names in every state. For example, we call it circle rate in Delhi, UP, Uttarakhand and Himachal. In Maharashtra, we call it Ready Reckoner Rate.

In Haryana and Punjab, it is called Collector Rate. If you want to understand stamp duty in more detail then check out our home page Circle Rate where we have given complete information about stamp duty calculation that how to calculate stamp duty on market value or circle rate.

In Bihar, while registering a property transaction, both stamp duty and registration rates are applicable. These rates are calculated based on the market value of the property or the transaction value, whichever is higher. For example, if your property is valued at Rs 100,000 and land charges are higher than the stamp duty, then you will be charged the land charges at that time.

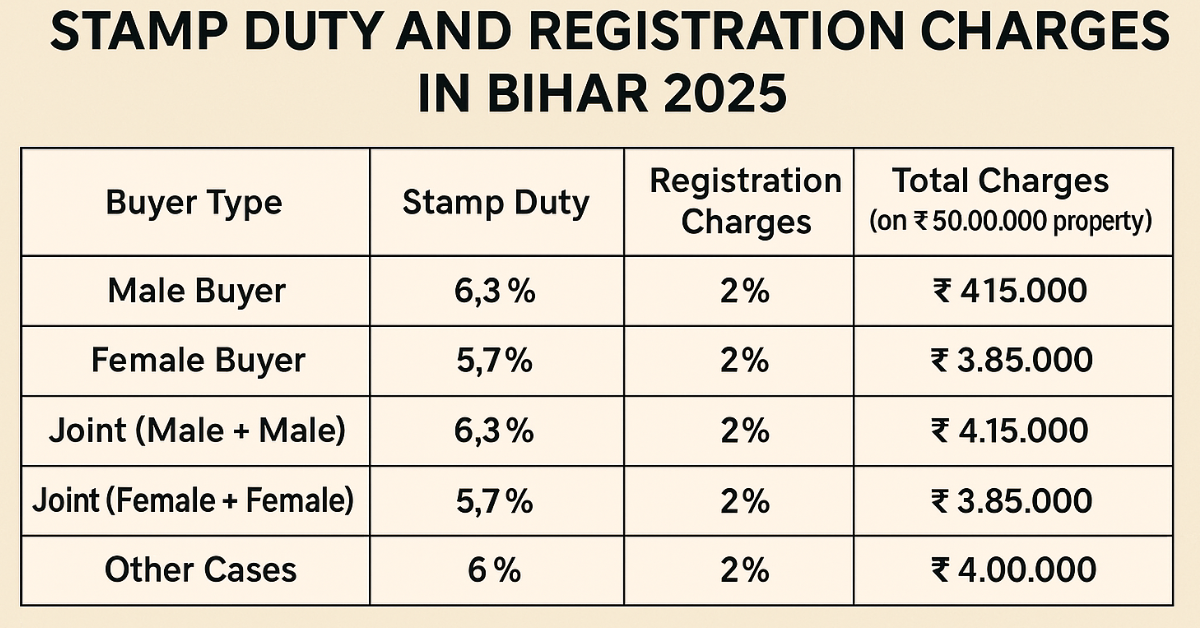

| Buyer Type | Stamp Duty | Registration Charges | Total Charges (on ₹50,00,000 property) |

|---|---|---|---|

| Male Buyer | 6.3% | 2% | ₹4,15,000 |

| Female Buyer | 5.7% | 2% | ₹3,85,000 |

| Joint (Male + Male) | 6.3% | 2% | ₹4,15,000 |

| Joint (Female + Female) | 5.7% | 2% | ₹3,85,000 |

| Other Cases | 6% | 2% | ₹4,00,000 |